PLACE YOUR ADS HERE

Custodia Bank, a Wyoming-based digital asset bank, is locked in a legal dispute with the Federal Reserve over its quest for a master account.

This account would grant Custodia direct access to the Federal Reserve’s payment systems, bypassing intermediary banks. The ongoing legal saga highlights the complexities and challenges faced by digital asset institutions in integrating into the traditional banking system.

Years-long Legal Battle

The legal battle between Custodia Bank and the Federal Reserve spans several years, starting with Custodia’s application for a master account with the Kansas City Fed in 2020. Despite Custodia’s efforts, the Federal Reserve Board of Governors intervened in the decision-making process, leading to delays and ultimately a denial of the application in 2023.

A Federal Reserve Master Account refers to an account that certain institutions, like banks or depository institutions, hold with the Federal Reserve. This account allows them to conduct various transactions with the Federal Reserve, such as depositing funds, withdrawing funds, and settling transactions.

These accounts play a crucial role in the functioning of the U.S. financial system, providing institutions with access to the central banking services offered by the Federal Reserve.

Having a master account enables institutions to participate in activities such as clearing checks, transferring funds between institutions, and accessing liquidity through discount window lending.

Court Rulings and Appeals

In March 2024, Judge Scott Skavdahl ruled against Custodia, stating that Federal Reserve Banks have discretion in granting master accounts. Despite this setback, Custodia remains determined to challenge the decision. The bank has now filed a notice of appeal with higher courts, seeking a review of the lower court’s rulings.

Judge Skavdahl emphasized the potential risks of a “race to the bottom” among states, highlighting, “Unless Federal Reserve Banks possess discretion to deny or reject a master account application, state chartering laws would be the only layer of insulation for the U.S. financial system.” He added:

“And in that scenario, one can readily foresee a ‘race to the bottom’ among states and politicians to attract business by reducing state chartering burdens through lax legislation, allowing minimally regulated institutions to gain ready access to the central bank’s balances and Federal Reserve services.

The judge noted that Federal laws do not mandate the Federal Reserve to give every eligible institution a master account.

Custodia Bank’s Argument

Custodia argues that without a master account, it is limited in its ability to provide custodial services for digital assets, impacting its competitiveness in the market. The bank contends that the Federal Reserve’s denial of its application was arbitrary and capricious, violating the Administrative Procedure Act.

According to Custodia CEO Caitlin Long, recent cases have highlighted the Federal Reserve’s broad discretion in denying new master accounts, raising concerns about fairness and transparency in the process.

Legal Implications

The outcome of Custodia’s legal battle with the Federal Reserve has significant implications for the adoption of digital assets in the traditional banking system. While Custodia emphasizes the importance of digital assets in a rapidly evolving technological landscape, regulators remain cautious about the risks associated with them.

Custodia operates under Wyoming law as a special purpose depository institution, akin to banks. They accept deposits and provide custody services but are restricted from lending customer fiat deposits, holding them entirely in reserve.

Related reading: Custodia Bank Can Help Bitcoin Companies Fix The Broken System

The “Race to the Bottom”

Judge Skavdahl’s ruling raised concerns about a potential “race to the bottom” among states to attract businesses by reducing regulatory oversight. Without Federal Reserve discretion in granting master accounts, state chartering laws would be the sole barrier to entry for financial institutions, potentially leading to lax legislation and increased risks for the financial system.

The judge stated in a decision last month:

“If Custodia’s position was correct, it would effectively mean that every depository institution chartered under the laws of a state, regardless of how soundly crafted, is entitled to a master account allowing it direct access to the federal financial system.”

Custodia’s Next Steps

Despite the legal setbacks, Custodia remains undeterred in its pursuit of a master account. The bank has filed notices of appeal with higher courts, signaling its commitment to challenging the Federal Reserve’s decision.

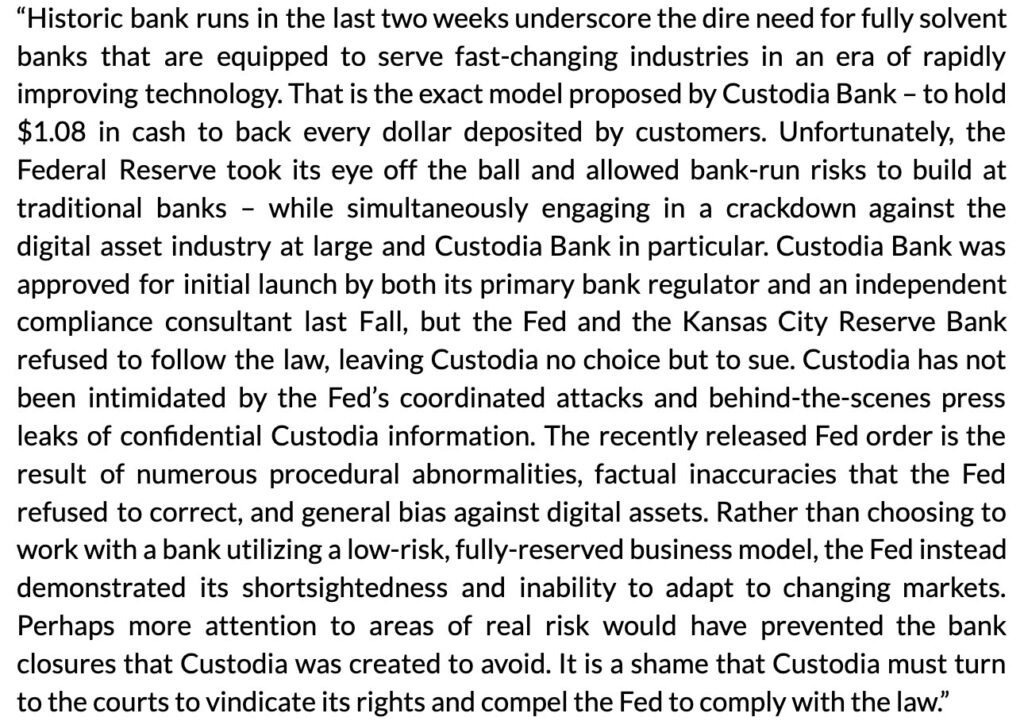

Custodia claims to provide a banking model suitable for “rapidly improving technology,” and protection against bank runs. They are dedicated to this mission and are considering legal actions against the “Fed’s strong-arm tactics”.

Custodia expressed that the bank was examining the judgment and lodged a protest against the Federal Reserve’s endeavor to gather legal costs. They contended that since the case was still in progress because of the appeal, granting the fees could discourage future lawsuits.

Conclusion

Custodia Bank’s legal battle with the Federal Reserve underscores the challenges faced by digital asset institutions seeking integration into the traditional banking system. As the case progresses through the appeals process, the outcome will shape the regulatory landscape for Bitcoin adoption in the United States.

English (US)

English (US)